In The Supreme Court of The Stratham Republic

CIVIL ACTION

Date: 05/02/25

Walmart

TokyoSAP (Wright.Co Lawyer, Representing)

v.

Nexus Bank

I. Description of Case

Plaintiff brings forward this lawsuit against Nexus Bank for the wrongful withholding of corporate funds belonging to Walmart following the permanent ban of a former individual account holder. Plaintiff seeks relief establishing that the withheld funds are the rightful property of Walmart and its management, and wishes the court to compel Nexus Bank to release all funds, including accrued interest, to Plaintiff immediately.

II. Parties

Evidence 2: Staff Payment Due Notice

In advancing this form to the court, you acknowledge and concur with the rules of court which highlight the importance of honesty at all times. Moreover, you understand the punishments for breaking these rules and/or committing perjury and deception in the court.

CIVIL ACTION

Date: 05/02/25

Walmart

TokyoSAP (Wright.Co Lawyer, Representing)

v.

Nexus Bank

I. Description of Case

Plaintiff brings forward this lawsuit against Nexus Bank for the wrongful withholding of corporate funds belonging to Walmart following the permanent ban of a former individual account holder. Plaintiff seeks relief establishing that the withheld funds are the rightful property of Walmart and its management, and wishes the court to compel Nexus Bank to release all funds, including accrued interest, to Plaintiff immediately.

II. Parties

- Walmart, Plaintiff (TokyoSAP representing).

- Nexus Bank, Defendant.

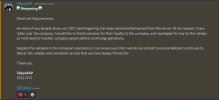

- On the 8th of January 2025, the former CEO of Walmart was permanently banned and the bank subsequently froze the company account belonging to Walmart.

- When the plaintiff attempted to access the corporate funds as the CFO and newly appointed CEO, he was denied by Nexus Bank.

- Walmart is a separate legal entity, independent of any individual account holder. The player who deposited the company funds into Nexus Bank, Saarthigaming, did not personally own the assets of Walmart, but merely managed transactions on its behalf and received a large percentage of the company’s revenue.

- Plaintiff, as the appointed CFO of Walmart prior to the ban (evidence 1), had full control of all company assets and did not require any upper management approval to withdraw funds.

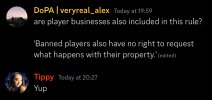

- Nexus Bank justified its refusal by citing Section 9.2 of its Terms and Conditions, which applies to banned personal account holders but does not reference or govern corporate accounts, making this withholding of company property a clear breach of contract.

- Nexus Bank does not require corporate accounts to be legally registered companies under a specific player, yet has treated Walmart as inseparable from Saarthigaming contrary to its own policies.

- Walmart has ongoing financial obligations, including employee salaries (evidence 2), supplier payments, and operational costs, and has been impacted operationally by Nexus Bank’s withholding.

- Release of all company funds held by Nexus Bank, including interest (KR 41,200), to the Plaintiff immediately.

- 2000kr for impact on company finances

- 1500kr Legal Fees

Evidence 2: Staff Payment Due Notice

In advancing this form to the court, you acknowledge and concur with the rules of court which highlight the importance of honesty at all times. Moreover, you understand the punishments for breaking these rules and/or committing perjury and deception in the court.